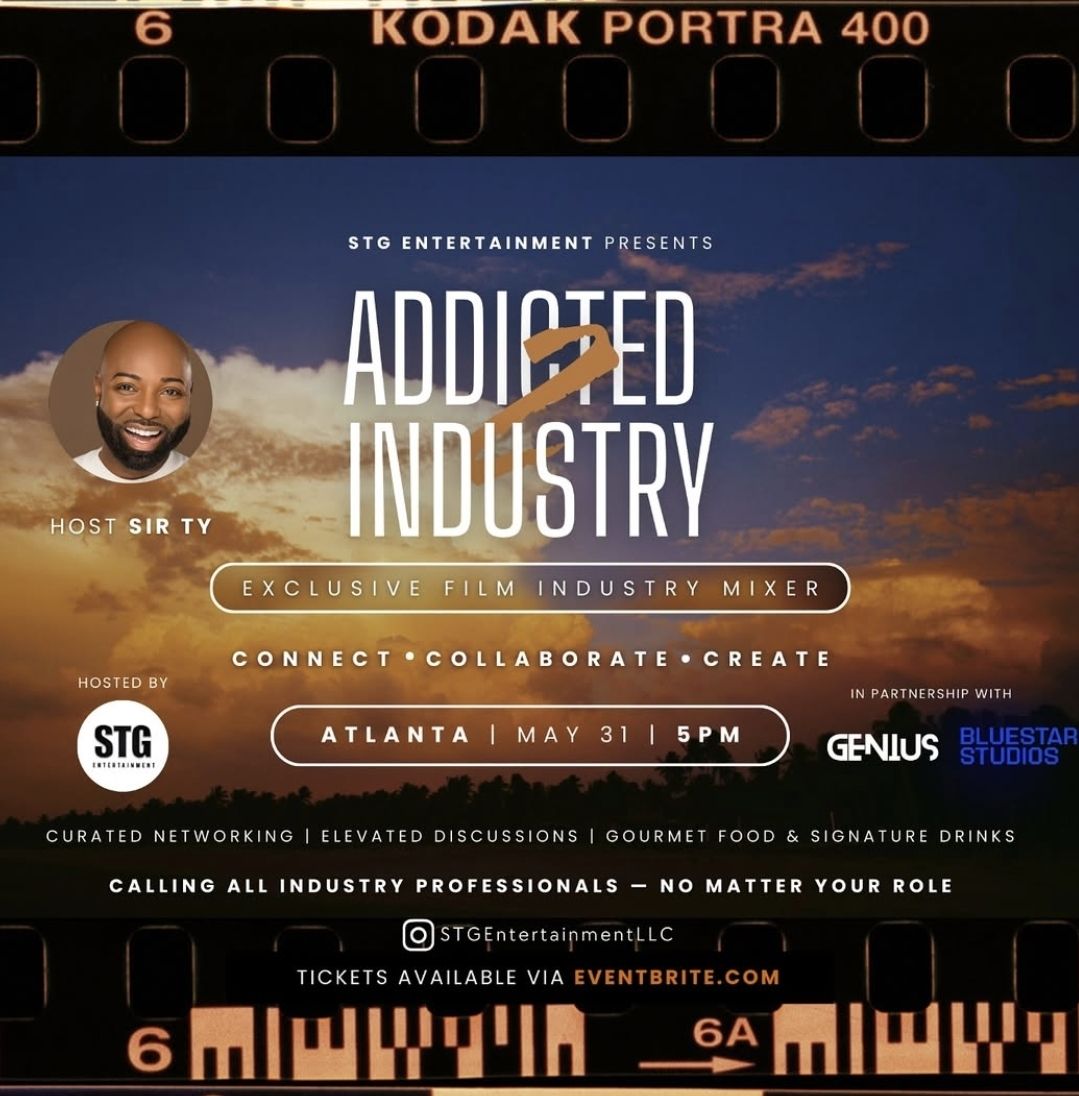

In less than a week, on Saturday, May 31st, if you’re in ATL or will be in ATL, find your way to Addicted 2 Industry event held by my friend and fellow creative SirTy of STG Entertainment. He’s a mogul in the industry. He’s the CEO of ForeverFathers, director, producer, actor, host, model, motivational speaker and so much more. I mean the list literally goes on and on. I am grateful to know him.

Last weekend, I had the pleasure of interviewing @SirTyOnline on IG live. The live video is available on IG and YouTube, and the audio is available on the podcast. During the interview, he gave us details on his upcoming event, Addicted 2 Industry, and the purpose behind it. If you are looking to get into the film industry, this is the event for you. Whether you’re an actor, singer, photographer, director, producer, crew, etc. you need to be in the building! This is a networking event, and connections will be made. Get your tickets now HERE! The flyer for the event can also be viewed in PopOut Magazine, where this month’s edition, features Kenya Moore on the cover.

SirTy and I go way back, like 25+ years ago. He has remained a positive force and a ball of energy. He has a heart to help others, whether it’s by motivating or creating a space of others to succeed in life. This event will be no different. The last time SirTy and I chatted was in 2019, when he hosted a stage play, No More Tears. Take a listen to that episode, Dear Dreamer. If you don’t know him, get to know him. Tune in to get the deets on everything he has going on this year. He is blessed and booked all year long. Follow his journey. Support and be encouraged!

Sincerely,

Angie