Vow to Never be Broke Again

Do you have a “broke” number? If you’re not familiar with what a broke number is, it’s basically a number that you get down to in your finances, where you start to consider yourself broke. It’s a number that should scare you. I also talk about this in a recent podcast episode here.

I found out in 2014 that my broke number was $10,000. In 2011, I left a job that I had been on for 7 years and started a new one 4 months later in 2012. During the 4 months I wasn’t working, I was living off of my savings. The new job paid me significantly less than my previous job, so I was still using my savings to supplement the deficit. After 2 years of living off of my savings, I was approaching a number in my savings account that scared the ish out of me. Before reaching that number, I knew that’s where I was stopping. Because as I was approaching it, I would get nervous thinking about it. That’s when I started to make changes. I downsized as much as possible and I was able to maintain my broke number without touching the savings account for a few years.

Slowly but surely and in very small steps, I started to add money to increase my savings. You can see the growth in my blog posts in the budget tab. I went from saving $2, $5, $15+ dollars at a time, to saving $200, $500, $1,500+ at a time. I went from praying to be able to save $10,000 to saving $10,000 in almost two years, then to saving that in less than one year.

Vowing to never get that close to only having $10,000 in my savings, to being able to save $10,000 in less than a year, only came from the feeling of not having that security. I learned a few things during a span of 5 years that helped me to grow. Since then, my “broke” number has changed and that change came in 2018. That means it took me about 7 years or more to learn my finances, grow my finances and to get comfortable with a much larger “broke number”.

Here’s what I did:

- I started paying the full 10% of my tithes.

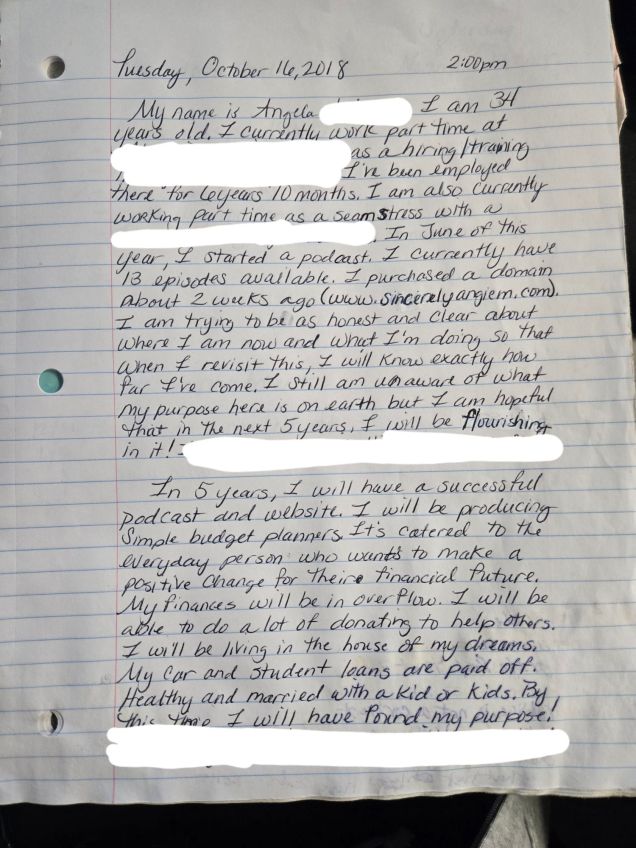

- I wrote down everything and really learned who I was financially.

- I elevated each time I reached a goal.

- I took a deep dive into my finances and learned them inside out.

- I set many goals, big and small.

- I pushed myself and always strived for a bigger goal.

- I sacrificed and had to practice discipline.

- I took advantage of any thing free, points and programs that rewarded me with free money. (Rakuten, surveys, loyalty programs, receipt programs, etc.)

- I counted every penny and knew where every penny was supposed to be.

If you’re reading this, it’s my hope that this post inspires change if you need it or motivation. This post is not to brag or boast. We all have a journey, and it took me nearly 10 years to get to this place. I vowed to never get close to my broke number again, and if life did happen and I got close to it, I know exactly how to recover it all again. NBA Angie!!! Happy budgeting!

Sincerely,

Angie