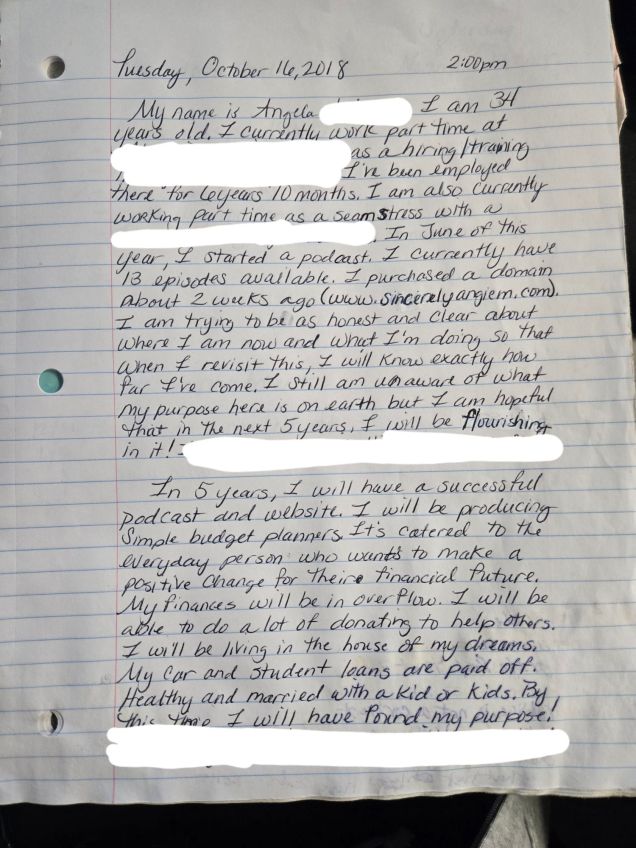

This post is almost 2 years late. But the 5 year plan I speak of, was made on October 16, 2018 at 2:00p. (It’s written down with the time and date.). Five years later would be October 2023, but I capped it at December 2023. This is the update from that time frame. Listen to the podcast for this episode here!

October 2018 me: I was 34 years old. I was working 2 part time jobs. One I had been employed at for 6-1/2 years. The other was a part-time seamstress job. I had recently started my podcast and just purchased a domain for my website. My goals were to find my purpose, get into a relationship/marriage, have kids, produce budget planners, have a successful podcast and website, pay off my car and student loans, finances in overflow, living in the house of my dreams and donating a lot to help others.

February 2025 me (October 2018-December 2023): Since then, what actually happened was…

- Credit score went from 715 to 816(highest).

- Wrote a book and created a journal, never published them.

- Practiced tithing the full 10%.

- Saved approximately $60,000+.

- From $13,000 in credit card approvals/limits to over $100,000.

- Maintained $0 credit card debt!

- Paid car off December 2020( 2-1/2 years early)

- Opened an IRA and maxed it out each year since.

- Contributed $5,000+ into the stock market.

- Approximately 50+ blog posts.

- Over 100+ podcast episodes.

- Over 100+ YouTube videos.

- Created budget worksheets for free download.

- I did get into a relationship but it didn’t last very long.

I didn’t reach all of my goals and I am okay with that because some things are on God’s timing, not mine. His timing is perfect and always worth it. I also accomplished way more than I planned to. Now that I have finally updated y’all, as promised on this 5 year plan, before I turn 41, I will make another 5 year plan.

Stay tuned, because I have to do a 2025 money/saving/budget post. My goal is to always share new tips, tricks and ways to help everyone grow financially. So, make sure you subscribe to this blog.

Sincerely,

Angie