Subscribe to get budgeting tips and more directly to your email! It’s free and you won’t get spam emails.

30 DAY SPENDING TRACKER: FREE DOWNLOAD

Net worth worksheet: Free download

Budget worksheet: Free download

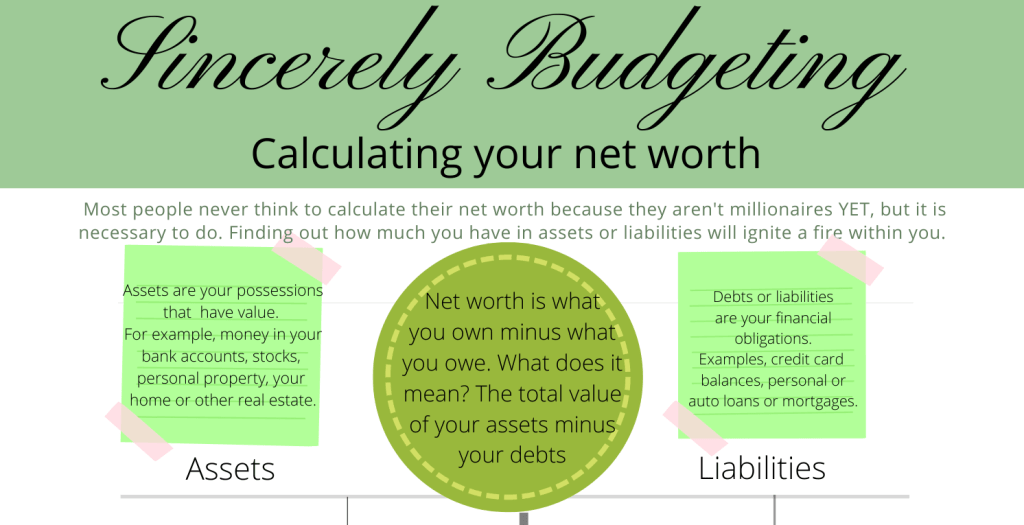

Calculating Your Net Worth Worksheet: Knowing your net worth isn’t just for millionaires. It’s for soon to be millionaires like you. Yes, you! Calculating your net worth will help you to determine if you have more assets than liabilities or vice versa. The goal is to have more assets than liabilities. Assets are items you actually own while liabilities are what you owe. Debt free is the goal for most and for some, good debt is the goal. Debt free means you owe nothing to anyone. Good debt could be considered minimal credit card debt.

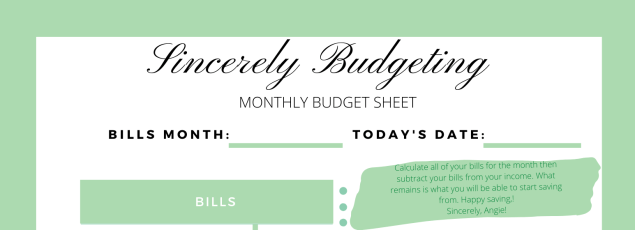

Monthly Budget Worksheet: This sheet is used monthly to organize your income and bills/expenses. This also will determine if you have money left over to save. You’ll find out if you have more bills than income and what you’ll be able to cut out.

30/31 Day Spending Tracker: For 30 days, you will jot down how much you spent or how much you received that day. At the end of the 30/31 days, you will add up each incoming entry and each outgoing entry. Write in the totals and subtract the outgoing funds from the incoming funds. Doing this will show if you are spending more than you receive and what you are spending too much on.

Once doing all or some of these worksheets, you should be able to determine if you are on the right track financially or if there are necessary changes to be made. Writing things down makes them more realistic. This also gives you a place of reference. You can come back to the worksheets and see how far you have come on your financial journey.

NBA Angie (Never Broke Again Angie)

Vow to Never be Broke Again

Do you have a “broke” number? If you’re not familiar with what a broke number is, it’s basically a number that you get down to in your finances, where you start to consider yourself broke. It’s a number that should scare you. I also talk about this in a recent podcast episode here.

I found out in 2014 that my broke number was $10,000. In 2011, I left a job that I had been on for 7 years and started a new one 4 months later in 2012. During the 4 months I wasn’t working, I was living off of my savings. The new job paid me significantly less than my previous job, so I was still using my savings to supplement the deficit. After 2 years of living off of my savings, I was approaching a number in my savings account that scared the ish out of me. Before reaching that number, I knew that’s where I was stopping. Because as I was approaching it, I would get nervous thinking about it. That’s when I started to make changes. I downsized as much as possible and I was able to maintain my broke number without touching the savings account for a few years.

Slowly but surely and in very small steps, I started to add money to increase my savings. You can see the growth in my blog posts in the budget tab. I went from saving $2, $5, $15+ dollars at a time, to saving $200, $500, $1,500+ at a time. I went from praying to be able to save $10,000 to saving $10,000 in almost two years, then to saving that in less than one year.

Vowing to never get that close to only having $10,000 in my savings, to being able to save $10,000 in less than a year, only came from the feeling of not having that security. I learned a few things during a span of 5 years that helped me to grow. Since then, my “broke” number has changed and that change came in 2018. That means it took me about 7 years or more to learn my finances, grow my finances and to get comfortable with a much larger “broke number”.

Here’s what I did:

- I started paying the full 10% of my tithes.

- I wrote down everything and really learned who I was financially.

- I elevated each time I reached a goal.

- I took a deep dive into my finances and learned them inside out.

- I set many goals, big and small.

- I pushed myself and always strived for a bigger goal.

- I sacrificed and had to practice discipline.

- I took advantage of any thing free, points and programs that rewarded me with free money. (Rakuten, surveys, loyalty programs, receipt programs, etc.)

- I counted every penny and knew where every penny was supposed to be.

If you’re reading this, it’s my hope that this post inspires change if you need it or motivation. This post is not to brag or boast. We all have a journey, and it took me nearly 10 years to get to this place. I vowed to never get close to my broke number again, and if life did happen and I got close to it, I know exactly how to recover it all again. NBA Angie!!! Happy budgeting!

Sincerely,

Angie

It’s Income Season

You read that right. Income season, not income tax season. I pray for the spirit of waiting all year for increase, to be removed from our minds and hearts. You can have increase at any given moment. All you need is the opportunity, expectancy and a renewing of your mind. Renewed mindsets brings about great abundance. Don’t wait all year for tax season to get a quick increase in your finances, income season can be yours all year long!

This year, try focusing on you receiving income and increase on a regular basis. Income, if we’re talking financially and increase when speaking of any and all areas of your life. Increase your self-awareness, self-control, relationships, health, peace, etc. Anything that is in coming, that you can receive is what you can train your mind to think of. I guess I could’ve named this post “Incoming Season” but it doesn’t have the same depth to it. Look up the definition of income and increase and seeing the definition might just change your mindset or life.

If you focus on lack or areas of your life where you are lacking something or there is a deficit, that lack could remain. Focus on increasing any area of your life where there may be a lack or where improvements can be made. This could range from anything like, your response when you’re mad or upset to improving your arrival time at work. Don’t limit yourself! We should always aim or desire to be better as a person not only for ourselves but for those around us.

Since it’s a new year, I have to provide y’all with money tips for the first quarter. Check out the new podcast on money with Eric Lewis from the IKG podcast.

It’s time for increase in your incoming funds. These tips are only here to give examples of how to cash in on some extra dollars. Do what works for you! Income is the key word so the goal is to have in coming funds! Lets start to cash out on some things we utilized last year.

- Cash out survey or referral programs points for Zelle, PayPal or Visa Gift Cards (ex. Rakuten or Fetch )

- Redeem your credit card points for cash or gift cards (ex. 25,460 points, could equal $254.00)

- Any interest that you may have gained on your savings accounts can be used to keep compounding or to move to another account for spending. You earned it. (Your savings account shows $5,138. The $138 is most likely interest earned (check your bank statement for interest earned total). Cash out the $138)

- Your stocks may be doing well. It’s time to check them and possibly cash out your initial investment to reinvest or use elsewhere. (You initially spent $500 on Apple stock, it’s currently worth $1,200. You could sell the shares that would equal $500(your initial investment) and keep $700 worth of Apple shares.) Remember, stocks are a long game, so only think of cashing out the initial investment if you really need the extra or if you deem it worth it.

Please note that anything that I have ever suggested when it comes to money and saving, I have done it personally or I have seen the benefits of it first hand. Happy saving, investing, cashing out and INCREASE!

Sincerely,

Angie

Be a Good Steward Over Your Finances in 2023

Definitions –

Finances: The management of large amounts of money…

Steward: Manage or look after…

Of the many money blog posts that you can find here on Sincerely Angie, this is probably the first of its kind. This post isn’t to tell you about the many ways to get money easily like I have listed in the past or mentioned in podcast episodes. Although I did upload an episode recently where I shared how money literally came from everywhere last year and I don’t sell a single product or service. Listen here if you’re curious. This post is to help you manage your money. It’s great to save money by using everyday things like online shopping (Rakuten) or getting gas (Fuel Rewards) but once you get the money you’ve earned, how are you managing it?

I won’t deviate from the basics like writing everything down, as this is necessary to keep track of it all. It’s not impossible but it’s a bit of a challenge to manage every dollar in your head for a whole week, month or even a year. Being a good steward over your finances will happen if you learn to be organized and disciplined.

- Get an understanding of who you are financially, what you’re making and spending and your why or goals. This will involve you writing things down and diving deep into your priorities, habits (good or bad) and who is actually in control of your money (you or the things you think you need).

- Tithe. Giving God 10% of your first fruits shows that you are obedient to His direction, you trust Him to supply your needs and you are grateful for the 100% He blessed you with.

- Be disciplined. Learn to sacrifice a week, month, or year of what you normally do, to get you to where you want to be and learn to say no.

- Prioritize and execute. Once you decide what is most important to handle first, pull the trigger on those things.

- Be obedient. If you are lead to bless someone, bless them. Your reward for being obedient will blow you away. God will bless you 30/60/100 fold, for your obedience.

Of the 5 things listed above, tithing was something that changed my life the most. In most of my years going to church, I would tithe but I was not doing the standard of 10%+. I would give a tithe and also an offering. Both together may have barely equaled the 10% I should have been doing strictly for tithes. Now granted, I was still blessed because I believe God knew my heart and intentions but when I was more educated on tithing, I did a better job. It was the best decision I’d ever made. Imagine having $100 and scared or too tight to give God at least $10. Once you do it and you get blessed right back in return, your outlook changes and you realize that the $10 really didn’t hurt or take away from anything.

How many times have you been short on a bill or tab and it miraculously gets taken care of? Even times where you were sitting home wondering what to eat then someone calls you to bless you with a dinner outing? Have you ever applied for a job and once you were hired, they tell you that you were selected out of hundreds of other qualified individuals? That’s nothing but God. You may have made a decision to bless someone over being selfish or you chose priorities over wants. You are being rewarded for being a good steward over your finances. Try it out! You won’t regret it.

Sincerely Angie

My Method for Saving pt.2

March 9, 2017 was when I posted part one. I have posted many other blog posts and podcast episodes since then on how to save but part one has been the most popular. Since then, I have tweaked a few things. While writing this post I went back and read that post, I see that I will have to revisit a thing or two. I hope that part two will be as short and to the point as the first.

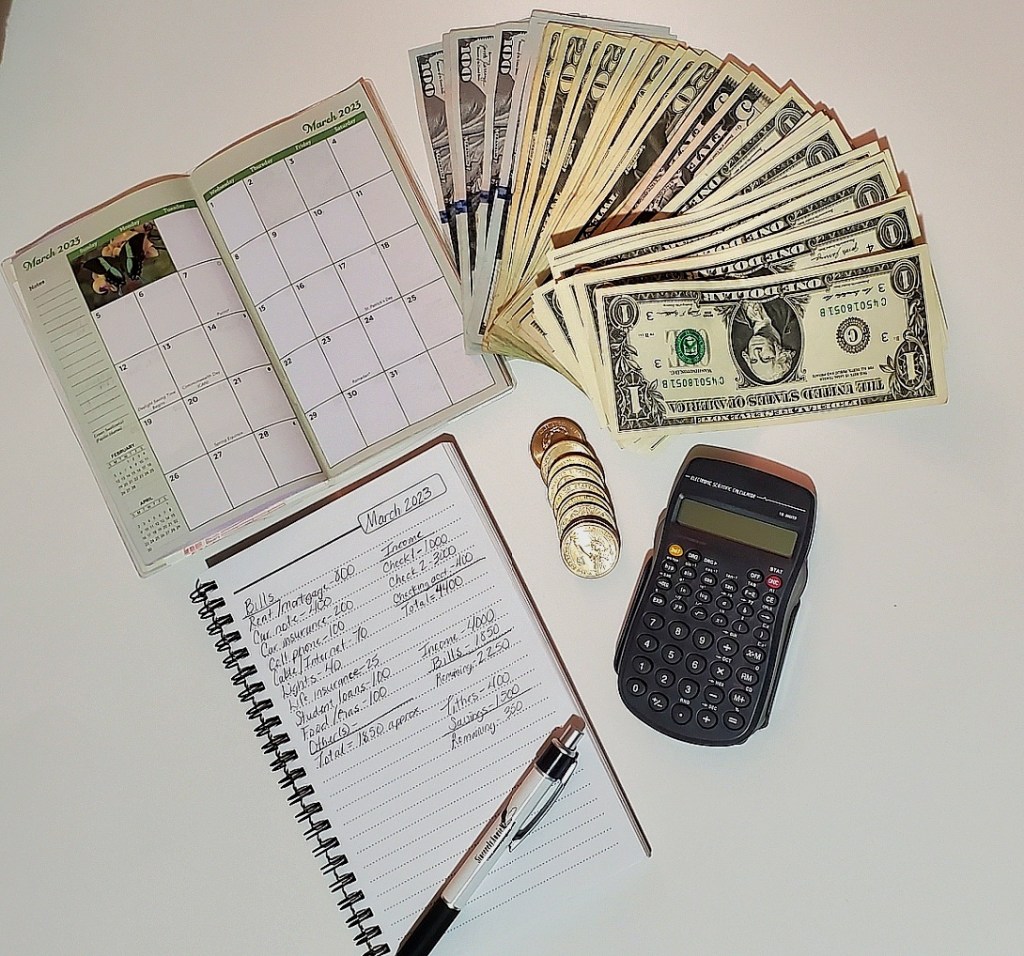

A lot has changed in 4 years. Mostly everything is digital now. This could make it easier or harder for some people to save. No worries, I hope my suggestions will help you out. First things first,

- Open a savings account if you don’t have one already. Try to find an account that is high interest yielding (An account that will pay you a higher interest rate than a normal savings account for your money sitting in the bank).

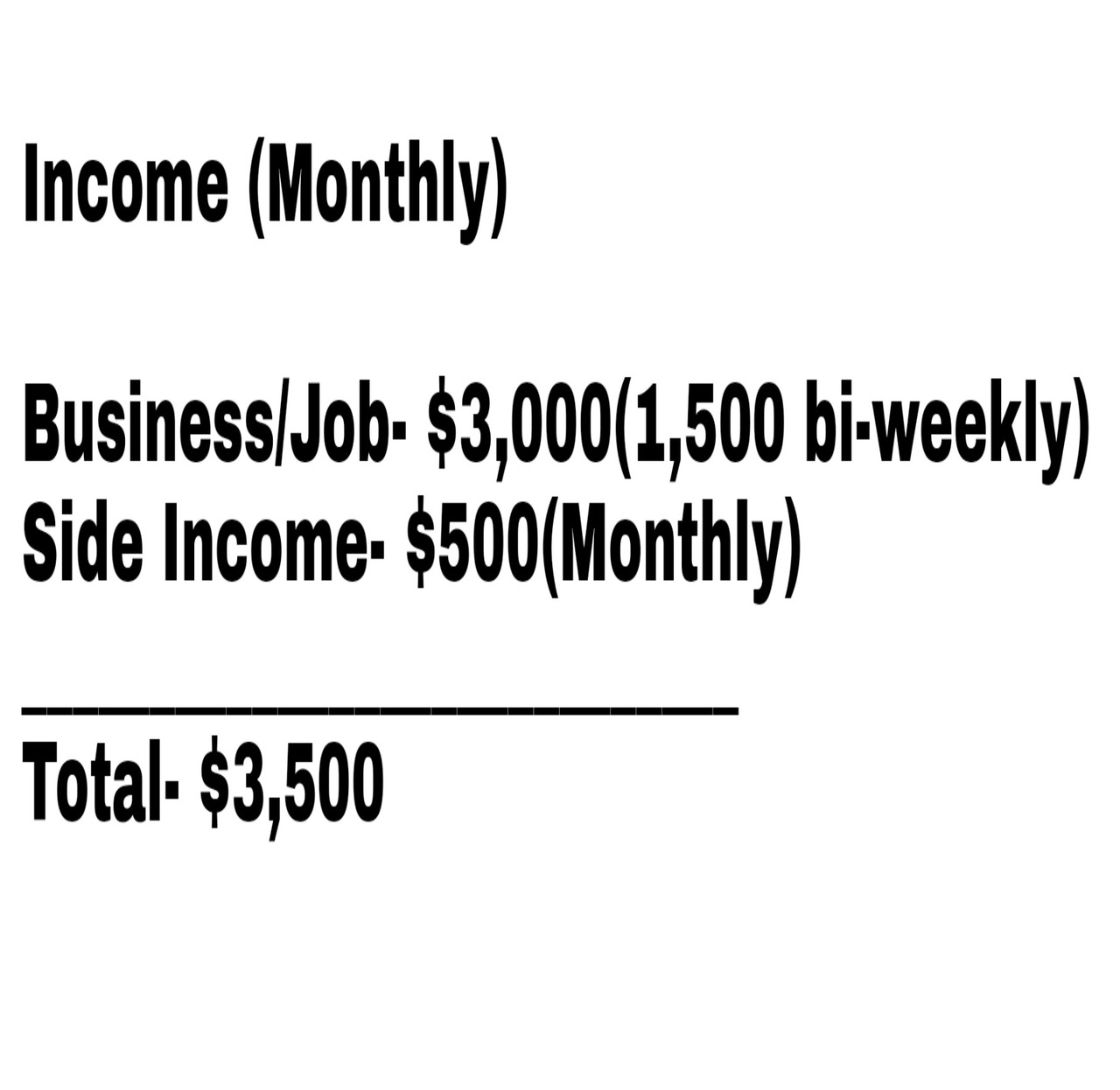

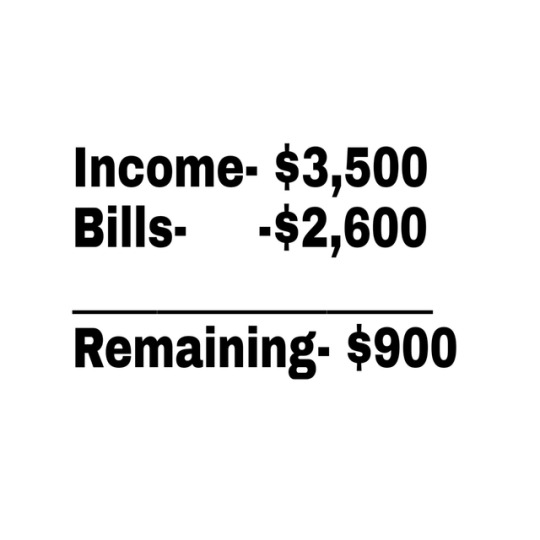

- Do an evaluation of your finances so that you’ll know realistically how much you can potentially save. (Calculate your income minus your bills, to determine how much is left over)

- Set a goal. (Try to save $100 for the week, pay period or month)

- Try doing a money challenge to get your savings ball rolling. (i.e. 52 week money challenge or $5 challenge)

- Cut out unnecessary spending. (Take a break from coffee shops, fast food restaurants, shopping for a while)

- Search online for class action lawsuits that may have affected you or unclaimed funds from the Treasury dept. (Once you get the check, put it into your savings account)

- Fill out surveys or utilize cash back websites when shopping online. (They pay you for referrals also like Rakuten)

- Redeem your cash back points for cash from your credit cards. (7,000 points could equate $50-$70cash depending on the company)

- Transfer small amounts into your savings account randomly. (If your account has $443.76, transfer $3.76 or 43.76 into savings. Do that weekly or as often as you check your account.)

- Use coupons when shopping for necessities (Put the amount you saved into your savings account. If using coupons caused you to save $15.88, put that amount into savings).

- Put any change that’s laying around the house or in piggy banks/coke bottles (large amounts i.e. $50 worth) into the bank. (Cash them out at the coin machine and deposit the money into your savings account.)

- Sell old clothes and/or shoes to a consignment shop or online and use the money you made to add to your savings account.

- Don’t be afraid to ask for monetary gifts for special events instead of gifts. (This unexpected money goes into savings)

- Use the interest that you’ve earned on your savings account to achieve any additional money goals or to pay down debt.

Saving small is still saving. Don’t despise meager beginnings. These small gestures will create bigger gestures until saving is no longer foreign but a lifestyle for you. Check out my podcast, YouTube channel and other blog posts for even more savings tips.

Listen to the most recent podcast episode here!

Watch Dear Finances part 3 here. Featuring Eric Lewis from the IKG podcast.

What is interest and how does it affect me?

Interest definition from GOOGLE: (noun)

- The state of wanting to know or learn about something or someone.

- Money paid regularly at a particular rate for the use of money lent, or for delaying the repayment of a debt.

Hearing the word “interest” may be scary for some people but I am here to tell you that it doesn’t have to be. I explain it with a semi illustration on my newest YouTube video (watch here).

I go into minor details of interest broken down into Interest earned and Interest paid. If you have a savings account at a bank, you should be earning interest on that money. APY(annual percent yield) can range from 0.01% to 6.00% interest and/or maybe even higher. If you have ever had or currently have a loan that you are repaying, there is interest added to that loan that you have to pay.

Your best option to figure out where you fall on each type of interest is to do your research. Go to your accounts whether online, go through paperwork that you may have on hand or call the institution that you are affiliated with and ask them to tell you your interest rate on the account in question.

Please don’t think that interest does not affect you. It does! Directly! Knowing your interest rate on a savings account or a loan can save you a lot of money. Hundreds actually. Everything that I mentioned in the video are things that I have experienced. I learned the lesson for you!

Dear Budget,

0 Sincerely Angie

November 25, 2019 @ 10:25a

A new year is quickly approaching so you should have known that a money episode was coming. I have talked about budgeting before on many occasions, Dear Finance podcast episodes, Budgeting for Beginners, My Method for Saving over the years, New Year, New Money !

This time around, I am giving the who, what, when, where and why’s of budgeting.

How I budget, what is budgeting, why you should budget, when to budget, where to budge and what to budget and finally who can budget. This was a quick episode since I already have a few tips floating around. I just wanting to put it on your mind since a new year is knocking at the door. Be ready to answer!

Listen here or search Sincerely Angie on any podcast platform!

www.sincerelyangiem.com/podcasts

How I Saved $10,000 in 1 Year!!!

Tips discussed:

- Write it down! (Budget & goals)

- What type of savings account do you have? (Interest earned can help you to reach your goals.)

- Cut back and sacrifice. (Pick up a second job or skip that yearly vacation.)

- Be disciplined. (Do not touch your savings account.)

- Anything extra goes into savings. (Income taxes, stimulus check, birthday money, etc.)

Bonus tips:

- Do your research. (Savings account, how to budget, etc.)

- Challenges (Implement a money challenge or two to help you save.)

Dear Budget,

Nov 25, 2019

A new year is quickly approaching so you should have known that a money episode was coming. I have talked about budgeting before on many occasions, Dear Finance podcast episodes, Budgeting for Beginners, My Method for Saving over the years, New Year, New Money !

This time around, I am giving the who, what, when, where and why’s of budgeting.

How I budget, what is budgeting, why you should budget, when to budget, where to budge and what to budget and finally who can budget. This was a quick episode since I already have a few tips floating around. I just wanting to put it on your mind since a new year is knocking at the door. Be ready to answer!

Listen here or search Sincerely Angie on any podcast platform!

Do you know your net worth?

Aug 15, 2019

I know what you’re probably thinking, why would I, the average hundredaire or thousandaire need to know my net worth? Great question and I’m glad that you asked. LOL! There are many reasons why you should know your net worth but specifically, you should know it so that it can be used as motivation for a better financial future. Further down, you’ll notice an example worksheet to use to assist you in finding out your net worth.

Let me slow down and start at the beginning. What is net worth? Net worth is what you own minus what you owe. What does it mean? The total value of your assets minus your debts. What are assets? Assets are your possessions that have value. For example, money in your bank accounts, stocks, personal property, your home or other real estate. What are debts? Debts or liabilities are your financial obligations. Examples, credit card balances, personal or auto loans or mortgages. How do I calculate it? To calculate your net worth, first add up all of the things that you own and then subtract all of the things that you still owe money on. Now that I know this, what happens next? Create a net worth statement and update it yearly. This will help you to see your growth and financial progress and help you to better meet your financial goals. Knowing where your money is and its growth potential as well as knowing how much money you have is necessary. You can avoid a lot of financial mistakes that your parents or those close to you may have made and you can educate your kids, who are the next generation. Most importantly, seeing a positive or negative net worth will motivate you to go harder to live a debt free life and a life of abundance! After all, when you know better, you do better.

If you haven’t gotten into investing and would like to start, knowing your net worth is one of the first steps. If you have trouble budgeting and saving and you need a little help, I have blog posts and podcast episodes to help you along the way. Budgeting, saving and your future! KNOW YOUR WORTH (in all aspects)!

P.s. Please don’t just take my word for it. RESEARCH!!! I am still growing and learning and I share as I learn. Don’t be afraid to seek financial counsel!

NET WORTH WORKSHEET

Assets (your possessions that have value)

Savings Account $ ________________

Checking Account $ ________________

Investments $ ________________

Life Insurance Policy $ ________________

Retirement Fund $ ________________

Profit Sharing Equity $ ________________

Employer Savings Plan $ ________________

Personal Property $ ________________

Pension Equity $ ________________

Real Estate (Home included) $ ________________

Other $ ________________

$ ________________

Liabilities (your financial obligations)

Mortgage Balance $ ________________

Car Loans $ ________________

Credit Card Bills $ ________________

Unpaid Medical/Dental Bills $ ________________

Home Equity Loans $ ________________

Personal Loans $ ________________

Unpaid Taxes $ ________________

Other $ ________________

$ ________________

Total Assets $ ________________

Less

Total Liabilities $ ________________

Net Worth $ ________________

Budgeting for beginners

Life gets hard and adulting sucks but until we learn how to manage the small daily tasks and responsibilities, the possibility of getting ourselves back into negative financial situations will remain high. Having a great relationship with money will insure that you can head problems off at the pass. I am sharing 5 steps on how to begin budgeting and I have also attached examples just to give you an idea of how you can start. Budgeting requires you to be active and disciplined, so please be prepared to be honest with yourself. There are podcast episodes, where I discuss finances and budgeting, check them out to learn more.

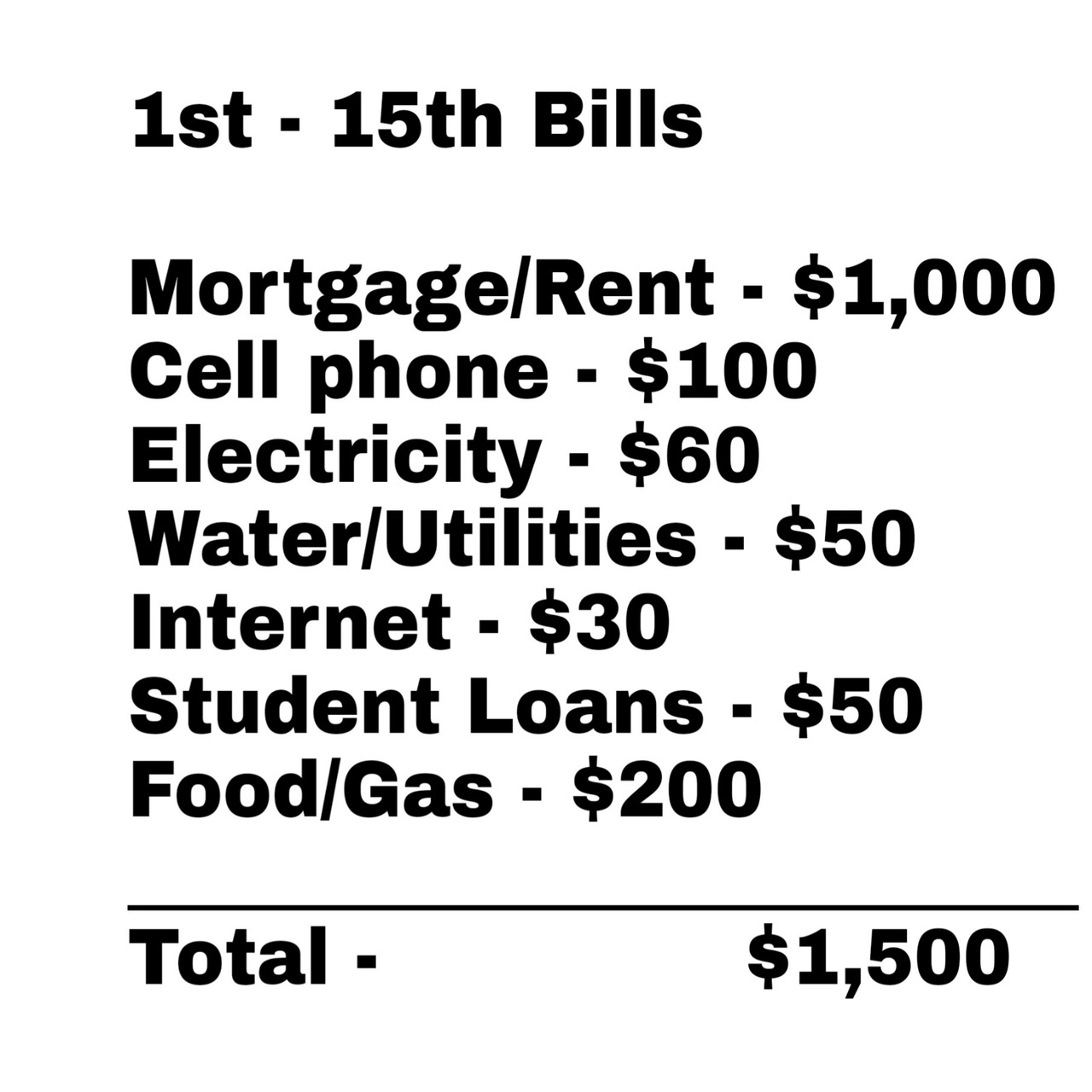

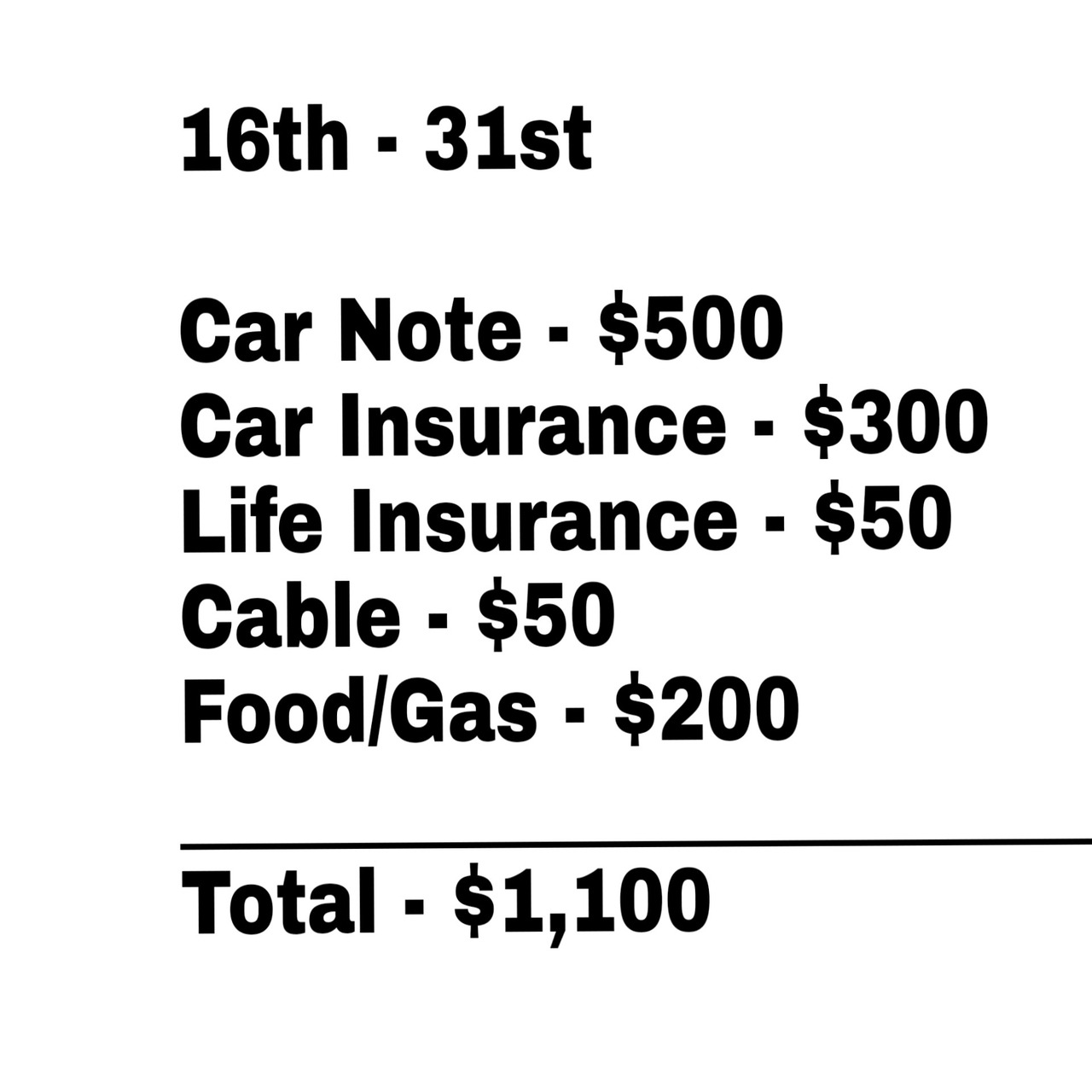

1. First thing, is to write down all of your bills for the month along with their due dates and calculate them.

-This may or may not change monthly but focus on the upcoming month. The other months will get their turn.

2. If you are paid weekly, bi-weekly or whatever income you receive during the month, calculate it.

-You’ll need to do a budget list on a month to month basis, as some bills for the month are subject to change and income may vary month to month.

3. Subtract total bills from total income for the month.

-This will allow you to be able to see if you’re spending more than you’re making

4. Separate the bills into those due during the first half of the month and those due during the second half of the month.

-It’s possible that you’re paying some bills earlier than you need to.

5. Next step is to see what bills are necessary or what bills can be downgraded or eliminated(i.e. Cheaper internet package or cable package. Cut out Netflix or Hulu and gain access through a family or friend.)

If downgrading/eliminating isn’t applicable/necessary, then it’s time to implement budgeting. After seeing what’s left after the bills are paid, you should start to spend the extra wisely. Food, gas and necessities have already been subtracted, now you want to have a set amount of cash on you to spend until your next income is received. This way you’re not swiping your debit card and losing track of available or accounted for monies.

Please remember that the changes that you are making are only temporary until you can get your finances in order. This is not a forever thing.

Hopefully this helps. There is a lot more to budgeting but this is the best place to start. 😊

Dear Finances

August 16, 2018

Ebates – www.ebates.com/r/BANANA2629?eeid=28187

Ibotta – ibotta.com/r/roxkmwo

Walmart savings catcher – Download the app in the app store.

Shell Fuel Rewards – www.fuelrewards.com/fuelrewards/welcome.html?RefId=6c0d42d1c72044b2aeea5bf27f6b7ac7

Blog post on saving: sincerelyangiem.tumblr.com/post/170664927775/new-year-new-money

New year, new money!

2/8/18 @ 6:30pm

This year I am focusing on saving more without watching it and taking from it. I recently watched a Lisa Nichols interview and I have seen her face before but never heard her story. She put money into a savings account from side work that she was doing and years later went checked the balance and was amazed. This caused me to start thinking of ways to start saving more without being tempted to touch the money.

I am always looking for ways to save money. Whether it’s using coupons, discount codes, clearance/sales racks/aisles, I’m all for it. I have been using Shell gas since I started driving and last year I started using Fuel Rewards. With FR, you save 5 cents a gallon every time you fill up to 20 gallons. I’ve saved close to $70 on gas in less than a year. I also use Wal-mart’s Savings Catcher app, where you scan your receipt and Wal-mart looks for the the same items in your area for cheaper prices and gives you back the difference if they find cheaper prices. I’m up to $16 in rewards dollars that I have gotten back. I just started using Ebates and got my first $10 back. It can be linked to your PayPal account so you get actual cash and not points. With Ebates, you save while shopping online at your favorite stores. They find coupons as well as extra percentages off. I just started using Ibotta and after you go shopping, just scan your receipt and you get cash back from items that you select before shopping. It seems to be just like the Wal-mart app but you are not limited to just Wal-mart. I also went to unclaimed.org to see if I had unclaimed money waiting for me, I did. So I filled out the necessary paperwork and mailed it in.

Click the names of the apps or sites that I have used to learn how to save more. It may seem like these are small amounts of money to be excited about saving, but considering that I don’t save that much that often, it’s a start. I will place the funds that I get from all of these accounts into its own separate account and at the end of the year I think that I will check the account to see how much I saved by doing what I do on a normal basis. Happy saving!

When I got my first job at 17, I was getting paid about $225 every two weeks. This was before direct deposit so I actually received a paper check that I had to go to the bank and cash. I didn’t have bills at this time so I would deposit $200 into my savings account and keep the $25 to spend for the next 2 weeks. I did that for almost 2 years. Then my second job I was getting paid every week so I did the same thing. If a check was $150 for that week, I would bank $125 and use the $25 for that week.

Gas and food was a necessity but I worked at a restaurant and lived with moms. I didn’t eat out a lot. I shopped on clearance when I did shop so 15 years ago I was able to make $50 go far. Personal products, leisure time and activities were included. I almost never went into my savings account. It had to be an extreme emergency, which I almost never had. If I couldn’t buy it out of the cash I had on hand or the extra in my checking account, I didn’t need it.

By my 3rd job, I was making a few dollars more per hour than my first two jobs. Clearing between $500-$600 every two weeks. Still did not have many bills. A car note and car/life insurance and a cell phone bill and helping moms out with a few bills. I was still able to save about 300-400 dollars a month. Months later I moved out and got my own place. By this time, I had been working for a few years so I was comfortable with saving and budgeting. Then Hurricane Katrina hit and my apartment complex closed. Now I’m back to saving an extra $500 a month since there was no rent or utilities. I would probably say that I was addicted to watching my saving accounts grow.

I still operate by this method til this day but it’s less money being saved because there is very little cash on hand on a regular basis. I operate a tad bit differently because I do a lot of online banking. If my checking account has $637.18 in it, I would transfer $37.18 or $7.18 to my savings account. That’s dependent upon what is due in the next couple of weeks. This way I am still saving but in smaller amounts. I check my account weekly and sometimes every few days and I will round it off every time I check it. Sometimes only transferring $2.75. At the end of the year it can sometimes total $300+ dollars. If I didn’t save this way, I wouldn’t be able to save at all because there is no cash on hand, just swiping a card.